Tax season is looming…It’s important to understand your tax rights, entitlements and obligations. This way, you can keep your tax affairs in order…and maybe even get a tax refund!

Here are 14 things you need to know about doing your taxes brought to you by the experts at Taxback.

1. Determine your residency status

The most important thing you should know is that your tax obligations will always be determined by your ‘residency status for tax purposes.’ Knowing your status will help work out what your tax responsibilities are.

There are a number of factors involved in determining your status, including your residential ties with Canada, length of stay, the purpose of your stay, and more.

Significant residential ties to Canada include:

- a home in Canada

- a spouse or common-law partner in Canada

- dependants in Canada

Secondary residential ties include:

- personal property in Canada, such as a car or furniture

- social ties in Canada, such as memberships in Canadian recreational or religious organizations

- economic ties in Canada, such as Canadian bank accounts or credit cards

- a Canadian driver’s licence

- a Canadian passport

- health insurance with a Canadian province or territory

To determine the status of your residency, all of the relevant facts in each case must be considered.

Non-resident for tax purposes:You are considered a non-resident for tax purposes if you normally, customarily, or routinely live in another country and are not considered a resident of Canada or you do not have significant residential ties in Canada. |

Ordinary resident for tax purposes:You are considered an ordinary resident in Canada for tax purposes if Canada is the place where you regularly, normally or customarily live.

|

2. Know your SIN

A SIN is a nine-digit number that government agencies use in order to identify you. You need it to work in Canada, and to pay taxes, or access government programs and benefits, like Employment Insurance (EI) and the Canada Pension Plan. Know your SIN before you sit down to file your taxes!

3. Income Tax rates

Canadian taxpayers are liable to pay both Federal and Provincial tax on their earnings.

The Federal Government collects personal income taxes on behalf of all provinces, except Quebec which has its own tax system.

There is a yearly tax-free allowance of $12,069. This means you can earn up to this amount without paying federal tax on your income.

The more you earn over this figure, the more tax you’re legally obliged to pay. Federal tax rates start at 15% on the first $48,535 of taxable income and provincial tax rates depend on the province where you work.

4. Understanding the tax you pay

Generally speaking, you’ll pay three types of taxes:

- Income tax: this is displayed in box 22 of your T4.

- Canadian Pension Plan (CPP – box 16): This forms one of the two major components of Canada’s public retirement income system, the other component being Old Age Security.

- Employment Insurance (EI – box 18): The employee rate for 2020 is 1.58%, down from 1.62% in 2019. The rate is 1.2% in Québec, down from 1.25%.

5. T4

Your T4 is an important slip of paper that you will need in order to file your tax return in Canada. Your employer should provide you with this by 28 February.

A T4 is a summary of the income that you earned and the tax that you paid in a particular tax year. If you work in multiple jobs in Canada you will receive multiple T4 slips.

If you lose your T4, you should contact your employer directly right away. Alternatively, Taxback.com can help you to track down missing tax documents including T4s.

6. Understanding your expenses

If you earned over the tax-free allowance, then you may be able to claim on the cost of certain expenses to reduce your overall tax liability.

Examples of eligible expenses include:

- Medical (for example – visit to the doctor, prescriptions, and surgery)

- Travel (for example – monthly transit passes until June 30, 2017)

- Tuition fees

- Donations

- Union dues

- Business (for example – rent, supplies, travel, and professional fees)

You will need to ensure that you have proper documentation for each expense if you want to claim tax relief on these costs. So keep any receipts you have safe!

7. Sales tax

In Canada, all consumers are charged sales tax when they pay for goods and services.

Depending on the province or territory in which you pay for the goods, you will also pay GST, or PST, a combination of both, or HST.

The sales taxes paid for purchases are not refundable for individuals in Canada.

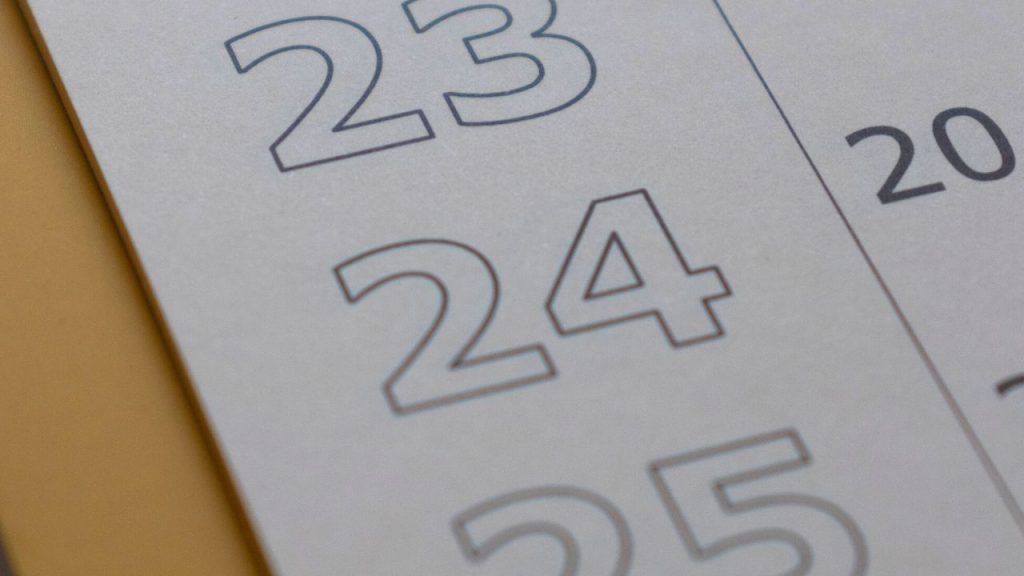

8. When is the earliest filing date?

E-filing opens for resident and immigrants in Canada for the 2019 tax year on February 24, 2020.

If you wish to get the paperwork out of the way as early as possible, this is the earliest date you can file.

9. When is the tax deadline?

April 30 is the deadline that most you will need to keep in mind. However, if you are self-employed, you will have until June 15 to file – although, if you owe taxes, you still need to pay up by April 30.

Did you know? If you’re late either settling your balance or sending your paperwork in, you could face late filing penalties as well as daily interest charges on any taxes owed!

10. How to file

You can apply directly with the Canadian tax office, or you can use a tax agent such as Taxback.com.

Did you know? Hollyburn members can avail of a 15% discount on their tax filing applications, and 10% discount on any other tax countries they file taxes for, Taxback.com also offer free tax refund estimations for everyone!

Why Choose an Agent:

If you self-file, you will have to:

- Determine your residency status and gather all the necessary documents yourself, which can be a hassle.

- Take responsibility of compliant filing of your tax return will lie with you.

- Your tax return may be audited, and if filed incorrectly you must pay back any tax refund received and re-submit your application.

By applying with Taxback.com you can enjoy a fast and stress-free service, so you can sit back and let our agents do the work! What’s more? we can help you to locate any tax documents that you have lost.

11. Am I entitled to a Canadian Tax refund?

Whether you are due a refund or not depends on a number of factors including whether or not you overpaid tax.

Overpayments of tax in Canada can be broken into three categories: Overpayment of income tax, Overpayment of Canadian Pension Plan (CPP), Overpayment of Employer Insurance (EI)

Use the Taxback.com online tax refund calculator here and get a free estimate of how much your refund will be worth.

12. The 90% rule

If you earned income from outside Canada in the same tax year (January 1 – December 31) you earned income from Canadian sources, then you might not be eligible to claim the personal tax credits that allow you to earn Canadian tax-free income.

For example: if you’re on a working holiday visa and worked in your home country in the same year that you came to Canada, this will be of importance to you.

This rule basically means that if you earned more than 10% of your income outside Canada, you can’t avail of the personal tax credits. However, if you earned at least 90% of the income within Canada, then you can claim the credits.

If you are unsure about this, then it’s safer not to claim the credits. Even if you end up overpaying tax, you’ll get a refund of this when you file your tax return. But if you don’t fill out your TD1 correctly, you could end up owing more tax to the Canadian authorities.

13. Tuition fees

If you study in Canada you can claim eligible expenses as a tax credit.

What qualifies a course?

- If it was taken at the post-secondary level or (for persons 16 years of age or older at the end of the year) if it develops or improves skills in an occupation

- If the educational institution has been certified by Employment and Social Development Canada.

You must have taken the course within the tax year you are applying for, and after you pay your tuition you should receive a T2202, Tuition and Enrolment Certificate from the educational institution you attended. You should use this form in order to calculate your eligible tuition fee credit.

Note: You must claim your tuition amount first on your own return, even if someone else paid your fees.

14. TD1 form

There are both federal and provincial TD1 forms that you should know about. The purpose of the form is to determine how much tax you should pay throughout the year, and you must complete a new TD1 form with each new employer you have.

The TD1 form will also determine if you are eligible for tax credits. If you have multiple employers you can only claim personal tax credits once. The TD1 form should be given to you by your employer, you fill it out and hand it back to your employer.

Tip: If your employers does not give you a TD1 form – you should request it.

If you claim tax credits that you’re not entitled to – you will owe the CRA money when filing tax (this is the 90% rule mentioned in point 12).

To claim tax credits, you will need to enter the tax-free amount in box 11 (TD1 provincial form) or box 13 (TD1 Federal form), but if you don’t want to claim, put a 0 in box 13.

Feeling overwhelmed? Don’t worry Taxback.com will take the hassle out of tax filing for you! They will manage all of your tax return paperwork so you don’t have to! Enjoy a fast and stress-free service.

Get your free tax refund estimation here. Or, register for a call back from a member of the Taxback.com team here.

Taxback.com is offering all Hollyburn tenants a 15% discount on their Canadian tax filing services. They are also offering a further 10% discount on any other tax country you need to file taxes for limited to Australia, New Zealand, USA, UK, Ireland, Germany, Holland, Belgium, Denmark, Japan & Luxembourg.